By Aimee D. Griffin, Esq.

•

April 4, 2025

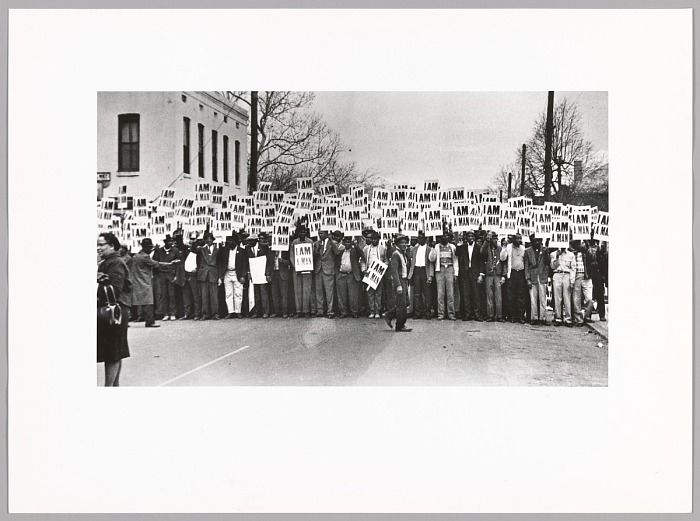

It was 60 years ago that The Washington Informer entered the stage of sharing news about and for the Black community of the Washington, D.C., metropolitan area. The vision of Calvin and Wilhemina Rolark, to be able to shape the narrative in 1964 of the community by the people who are living the story came to life in The Washington Informer. Entrepreneurship is not easy. It’s even more difficult when you are doing something to represent the people who are often disadvantaged and marginalized. The resources are not easy to be pooled for those with less discretionary income. However, it wasn’t their dream because it was easy. It was a dream because they saw a need and decided to be the vehicle to meet the need. The Rolarks were community activists through politics and publishing they were making and recording history. The mantel was passed to Denise Rolark Barnes upon the passing of her father. Denise is committed to continuing the important work that her family had begun and has incorporated the next generation into the work with her son Lafayette as the publisher of the Washington Informer Bridge DC that informs the next generation. The commitment to legacy building as exemplified by the Rolark heirs is not something that comes easily. It takes intentionality to build on a dream and decision to create values that can be thoughtfully passed on. The Washington Informer has had more than 60 years of bringing news and information that makes a difference to the community that may not be shared through the typical channels and through a lens of people who are culturally aligned with the readers. Denise grew up with the newspaper and understood completely the mission, goal and purpose. She shared the goals and committed her professional life to standing in the mission. While it was not easy, she saw the need and walk in that purpose. The Washington Informer is a voice for the community. As we reflect on the times that we are currently facing, it is familiar to the struggles that the Black community was fighting 60 years ago. It was a bit more than 60 years ago that we had the March on Washington to advocate for civil and economic rights. There is renewed frustration and advocacy for civil and economic rights with the current administration. There is indeed a call for another protest this month with civil and economic rights as the focus. The legacy that The Washington Informer has established with a commitment for being a voice for the voiceless is applauded and appreciated. We celebrate the effort that may feel unappreciated but needed during this time. I personally thank the Rolark Barnes family for the sacrifice of time, talent and treasure to build a legacy that supports not a family but a community and a country. In February, we proudly celebrated the great contributions that Black people have given to the world with Black History Month. I am honored to be able to be a member of the Black community. In March, we celebrate Women’s History Month. This is another group to which I proudly claim membership. We set apart these months to build up communities and honor those who have made great contributions, especially those who have not been given the recognition that was deserved. This country has failed to acknowledge the areas of disparate treatment. We must not wait for anyone else to celebrate our accomplishments. Communities and movements must take the time to share the impact to compensate for the lack of appreciation publicly given. I appreciate the quote, “Ginger Rogers did everything that Fred Astaire did, but backwards and in heels!” The revelation is that in most cases women are denied access and the opportunity to achieve goals and success. Over the course of history, women were measured with sticks that were not equally established. The facts show that there is a gender and racial income gap. We know that women were not allowed to open bank accounts without the permission or co-signing of a man for many years. Yet, women continue to impact the world by building businesses, often while simultaneously building families. I am honored to be a member of The BOW Collective, a group of Black Women Entrepreneurs who are committed to working together to break barriers. I celebrate the founder, Nicole Cober Johnson, Esq. She had the vision to displace the narrative that Black women-owned businesses only have revenue of $24,000 to create a collective where BOW level members have revenue exceeding $1,000,000 for a total membership of more than 300 women nationally with an annual revenue of $1.7 billion. Through The BOW Collective, I am privileged to meet amazing women who have a vast array of entrepreneurial experiences that include medical and dental practices, construction, hospitality, and even up to astronauts and arms dealing! We know that it is through the creation of jobs and businesses that we build communities. We know that small business is the economic engine of this country, and we are not on the sidelines watching things happen, but making things happen. I celebrate the intersection of Black History Month and Women’s History Month with The BOW Collective as we create herstory. We look for the opportunity to do business with excellence. We are not naïve when we seek to work together to change the world. We build deliberate partnerships that focus on working with people we know, like, and trust. We build strategic alliances that work collectively and collaboratively with excellence. We build networks that offer resources to open doors and blaze trails that provide opportunities for those who follow as we build the legacy. As Black women entrepreneurs, we know that there has never been equal access to opportunities and capital for the growth of business. It has been a continuous, upward climb, as we have been denied access and opportunity. Yet, as my father has always said, “Difficulty is no excuse for surrender.” We continue to do what is necessary to build and break barriers. We know that it is our commitment to ourselves, our families, and our communities. I am excited to work with individuals and families to build estate plans that include succession plans for business to preserve and protect the legacy that we work so hard to create.